I’ve taken quite the hiatus the past couple of months to relax, rejuvenate, reset and re-organize a few things. Oh, and build my net worth to 380K. I use personal capital to keep track of my net worth which consists of my savings account, retirements accounts, brokerage accounts, and equity available in my homes. During my time away I worked extra to bring in more money to pay off the heaviest but last weight I still carried with me, my student loan debt. As of January 15, 2021, I made my last payment to the ‘greatlakes’ and bid my loans farewell, making me officially debt free! **with the exception of my mortgages**

Money is hard. There’s a lot to think about. Should I save first, tackle my debt, invest? Does anyone sleep anymore? Surprisingly enough, I decided to focus on all of the above, and I in fact did sleep less during this time. I decided to take on more work so I could save more, pay off debt and then invest the rest. Paying off almost $35,000 worth of debt in 12 months and saving $50,000, challenged and pushed me in ways I haven’t before, but I gained a lot out it. I was able to save about $50,000 through retirements funds, HSAs, auto investing using robo advisors and auto savings, while attempting to live well below my means.

Current Snapshot

Here’s a current snapshot of that payoff and my current net worth:

Total Net Worth / Assets: $380,000 +- market fluctuations

Real Estate: 2 investment properties

Retirement accounts; 5 accounts total

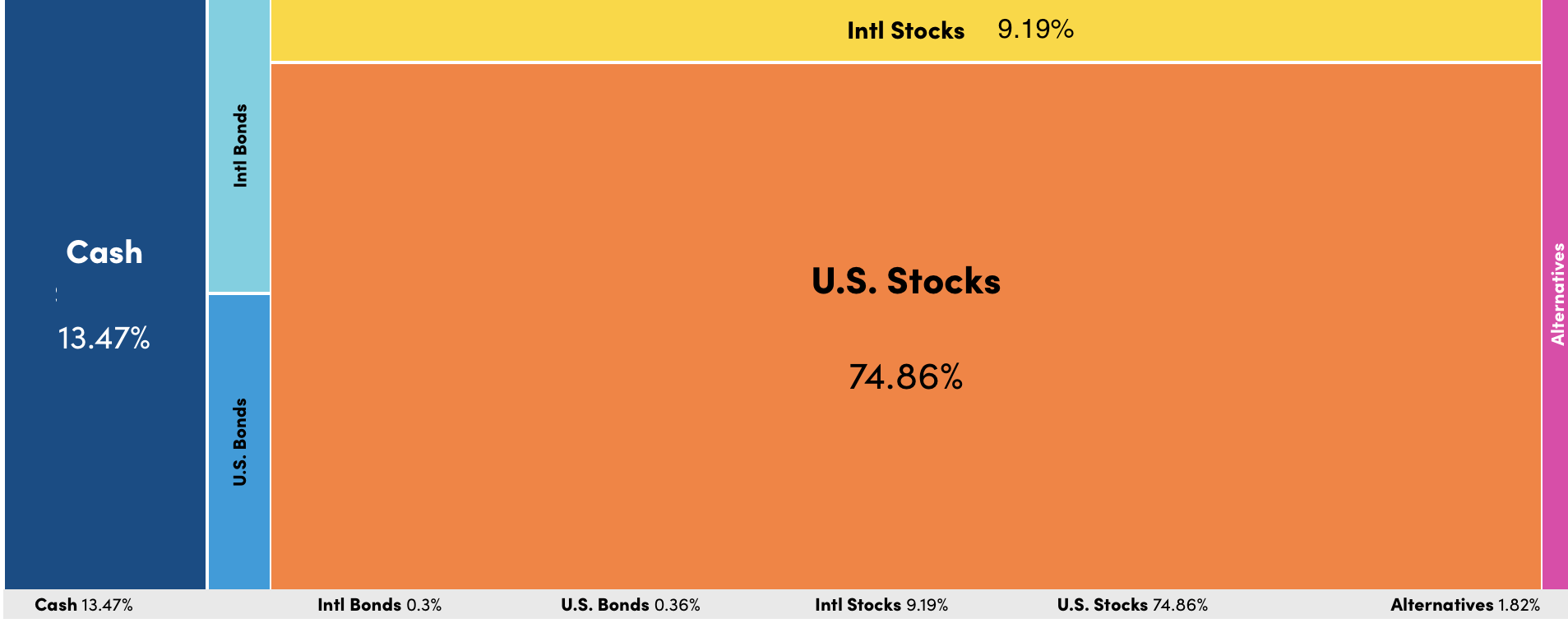

Brokerage account: Robo Advisors, Dividend Stocks, Value Stocks, Index Funds

Cash; 2 accounts

Health Savings Account started in 2019

Now that my head is back above the water, I should have more time for focused and dedicated writing. This post is to help remind myself and others that you don’t have to work until 65 and if you’re a bit creative you can retire early and comfortably. Set a goal, make sure you’re consistently taking steps to get you closer to it and continue! Hope you enjoyed this piece and catch you on the next one!