I’m 28 years old, have no children, although I plan on having two someday. THE GOAL: Become financially independent and retire in 10 years. That retirement will look like me living off of $40,000 a year with a $1,320,000 nest egg, but I’ll have to live off of 22K a year now to get there

My current debt

My total debt ($681,805.45): $4,000 left to pay on my car, $23,319.33 in student loans, and $654,213 in mortgages. Although my mortgages are considered assets, they aren’t paid off yet so they are still considered debt.

Where did this 22K a year living expense come from?

According to the trinity study, if you plan on retiring early and living off of your passive income from your retirement funds, you first should take the amount you plan on spending each year and multiply that by 33 to get your retirement number: (40,000 * 33) = $1,320,000.

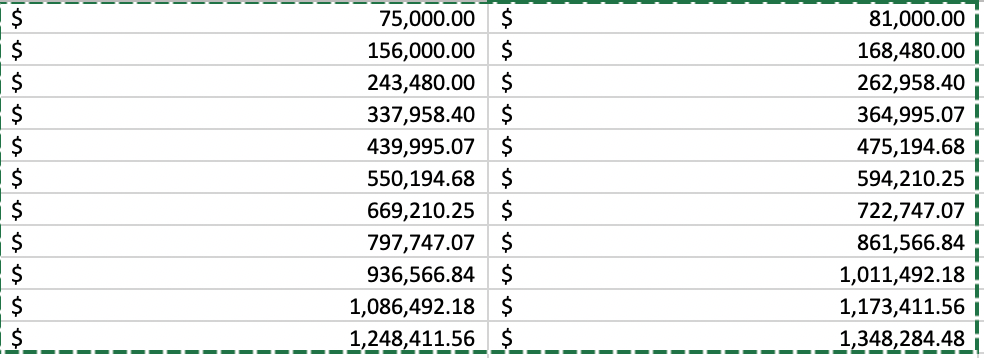

I make around 120K a year. For me to get to $1,320,000 in about 10 years, I would need to invest $75,000 a year, while achieving a 8% return. I also would have to only spend $22,000 a year.

Now Is This Actually Doable?

Current monthly expenses ($1414): $325 car payment (10 payments left), $125 monthly utilities, $35 phone bill, $143 cable/internet, $113 car insurance, $120 gas, $250 groceries, $50 gift fund, $253 student loan, $50 travel card. Amount I need to invest ($6250): $1625 401K, $500 IRA, $291.60 HSA, $3833.40 brokerage account. Based on my expenses and monthly income, I should be able to do this and still have ~$590.00 dollars who don’t yet have a job. I’ll call them my spontaneity dollars, but what does a lifestyle like this actually look like.

What does a 22K A Year Lifestyle Look Like?

Being that I have about $590 dollars left to play with on this journey. I can do a mix of a few things each month. I could put this towards additional debt (student loans, car payment), invest more to cut my 10 year goal down further, or enjoy the journey. I’ll focus on some fun things that’d I’d spend my money on:

- I can afford to eat out about once a week ($50 *4) = $250

- I can spend $100 on entertainment a month( Netflix, museums, concerts, etc) = $100

- 2 one hour massages ($60 + $20 tip) = $160

- Put the rest towards my travel budget / save it for a fancier month next month

Ways I can stretch this $590 — coupons, eating out for lunch vs dinner, splitting/sharing meals while out, thrift shopping, free activities, etc. The goal isn’t to spend the $590 a month but to give myself an idea of the sorts of activities that I can still do while doing this extreme savings plan.

I wrote this post to help anyone else thinking of retiring early. I As with any goal, it will require sacrifices. If you sacrifice for 10 years to enjoy a more flexible lifestyle that gives you the option to retire at least you now have a plan on how to get there.

What appeals to me most is being able to have the option to stop working if I wanted to. I would plan to live off of $40,000 a year. If I wanted to live a more lavish lifestyle I would look for part-time work. Instead of being forced to work I would choose when and if I wanted to work.

If you have any tips, questions or comments feel free to drop them below.