If you have a 403(b) keep reading. A member of my F.I.R.E. group has horrible 403(b) options and for this reason, I’m writing this post. Surprisingly, he is dealing with high fees from his 403(b) accounts which will take away about 20% of his gains over time. Yes, you read that correctly, 20%! Together with this 20% loss, there are employment taxes as he’s contributing them into a Roth 403(b).

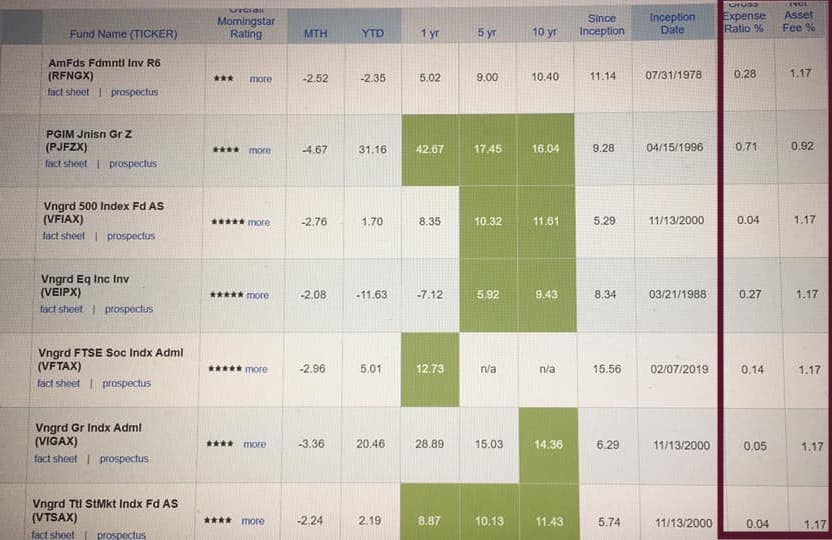

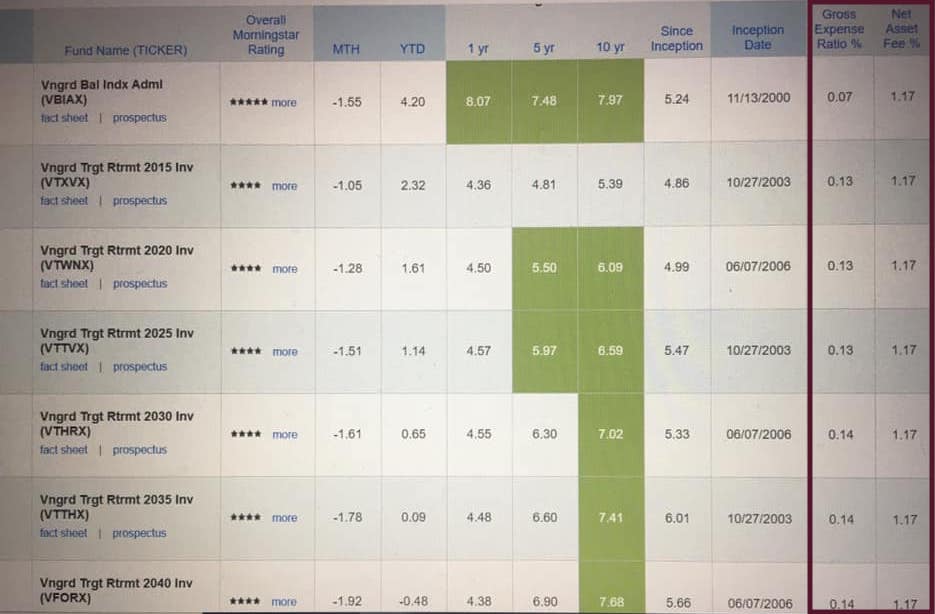

403(b) Options

403(b) Options

The Question: Brokerage or 403(b)?

Specifically, “Would it be better to contribute to a brokerage account instead of my 403(b)“? He’s considering this option to avoid the forced 1% management fee and the expense ratios, which in fact, would result in about a 20% loss over time.

Impact on Retirement Savings with Varying 403(b) Expenses

| Plan A | Plan B | Plan C | |

| *Gross Annual Return* | 7% | 7% | 7% |

| *Expense Ratio* | 0.58% | 0.80% | 1.30% |

| *Net Annual Return* | 6.42% | 6.20% | 5.70% |

| *Assets in Year 40* | $1,831,422 | $1,728,534 | $1,441,189 |

| *Difference from Plan A* | – | -$102,888 | -$390,233 |

| *Shortfall in Assets in Year 40 vs. Plan A* | – | 6% | 21% |

Here are some options we considered:

- Do you expect your taxes to be lower when you retire?

- Upon retiring, will you be moving to a state with lower taxes?

- Will you be making less income when you retire?

- Specifically, will you be in a lower tax bracket?

- Do you have an employer match?

- Can you contribute to a 457(b)?

- Are you eligible for a 457(b)?

- 457(b) vs 403(b)

- Should I contribute to a brokerage account instead?

- Do you have an employer match?

- Are you eligible for a 457(b)?

- Will your contribution be pre or post-tax?

403(b): When you retire, do you expect your taxes to be lower?

If this is the case, I recommended contributing pre-tax. Although you will get taxed 20 percent over time through the fund, you will be in a lower tax bracket upon retirement. You still pay less in taxes.

Should you contribute to a 457(b)?

Particularly, a 457(b) could be a safer choice if the employer plan fees are too high. A 457(b) is a retirement plan available to employees of the state, local governmental agencies, and 501(c) organizations. You may be eligible to contribute to both a 403(b) and a 457(b). This plan is occasionally referred to as a deferred compensation plan.

You can contribute to both a 403(b) and 457(b). In fact, if you have an employer match I would contribute up until the match in the 403(b) account and contribute the difference in a 457(b).

Should I contribute to a brokerage account instead?

Specifically, if you are trying to determine what will be the best option, consider these things. Firstly, does your 403(b) options all have very high fees? Secondly, does your employer not offer contribution matching? Thirdly, will you be contributing post-tax and are currently are in a higher tax bracket? Lastly, you cannot contribute to a 457(b).

To sum up, the best option would be to contribute to a brokerage account to save money on 403(b) fees. Furthermore, I hope this helped you if you’re in a similar situation.

You can read more of my posts here!